Executive Summary

IBM commissioned Forrester Consulting to conduct an Emerging Technology Projection: Total Economic ImpactTM (TEI) study and examine the potential return on investment (ROI) enterprises may realize by deploying an IBM Blockchain Platform and Services solution. The purpose of this study is to provide readers with a framework to evaluate the potential financial impact of IBM Blockchain Platform and Services on their organizations.

Blockchain is an emerging technology, and blockchain-based networks offer the opportunity to develop new business and trust models; that’s why the phrase “revolutionary potential” for once isn’t out of place. Its ability to support multiparty collaboration around shared, trusted data and process automation across organizational boundaries brings benefits at many levels, starting with efficiency gains and culminating in reinventing how entire industry ecosystems operate.

IBM provides a blockchain platform, blockchain services, and ecosystem support for organizations that are looking to develop and deploy their own blockchain solutions. To better understand the benefits, costs, and risks associated with this investment, Forrester interviewed six customers with experience using IBM’s Blockchain.

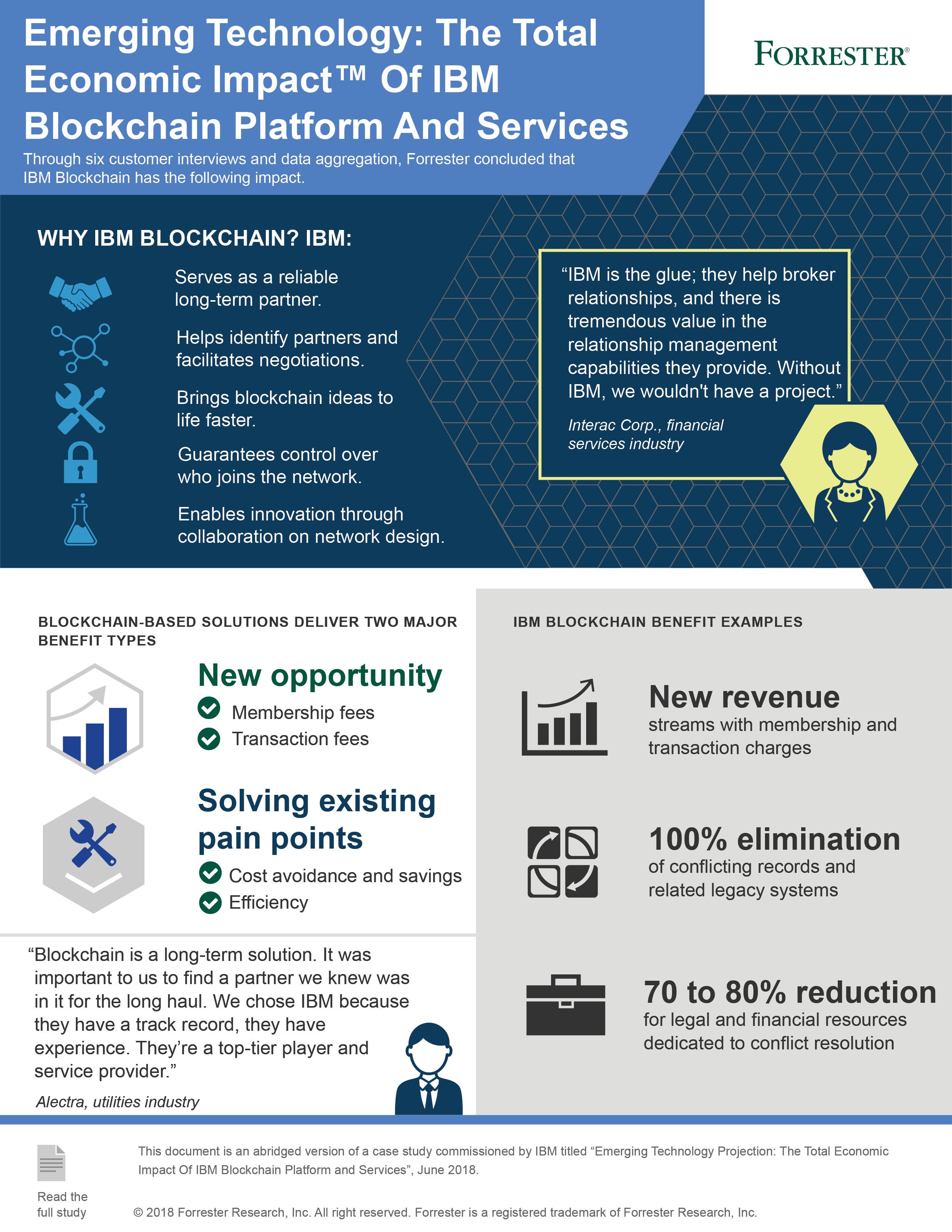

Organizations chose IBM as their partner for developing and deploying a blockchain solution for several reasons: IBM is seen as a reliable, long- term blockchain partner with a proven track record, large customer base, and relevant business and industry experience; IBM has deep technical expertise in blockchain technology to help bring blockchain ideas to life; IBM provides governance model expertise; the permissioned blockchain technology guarantees control over who joins the network and how they access information; and IBM’s collaboration on identifying and solving network problems enables progress in developing a blockchain solution.

There are two aspects that make the TEI analysis of IBM’s Blockchain solution unique:

- Interviewed organizations are implementing a wide range of applications and use cases using IBM Blockchain.

- Interviewed organizations for this case study have yet to deploy their full solution using IBM Blockchain Platform and Services.

As such, an emerging technology TEI methodology and framework is applied for this case study and analysis. Benefit and cost modules are abstracted from the interviewed organizations’ specific use-case deployments and generalized to a wider range of applications. What this means is that the reader should evaluate which benefit and cost modules are applicable for a specific blockchain application, and then calculate the associated financial analysis using the framework provided in the next sections.

At a high level, the benefit modules can be categorized as either creating new opportunities (green) or solving existing pain points (blue). It is possible that organizations could experience more than one of the identified benefits for a given blockchain solution. Costs are categorized as operation phase.

In addition to the identifying and quantifying example calculations in the benefit modules, an overall sample calculation combining two benefit modules, with the appropriate costs, is also provided as an example of how this analysis framework could be applied to your organization.