Microsoft Azure continues to command significant market share as the second-largest cloud hyperscaler. As the ubiquity of Azure grows, so does the need and opportunity to provide support for maximizing investments in Azure implementation. Leveraging Azure services partners can help organizations drive “better overall governance of [their] Azure implementation, accelerate [their] Azure strategy, achieve benefits at scale, and address requirements for Azure skills.”1

Between the pandemic-induced rush to remote working and organic growth in cloud adoption, the past few years have seen the rapid evolution of an already booming industry. Organizations are increasingly either born in the cloud or taking a cloud-centric approach to modernize their business. Subsequently, Microsoft Azure services partners are seeing rising demand for their expertise as their clientele’s Azure journeys become more advanced and they require more support to fully maximize the benefits of Azure. Furthermore, partners are changing the way in which they work with clients, providing more flexibility in their deal structures and placing greater focus on desired business outcomes to better meet the specific needs of each customer.

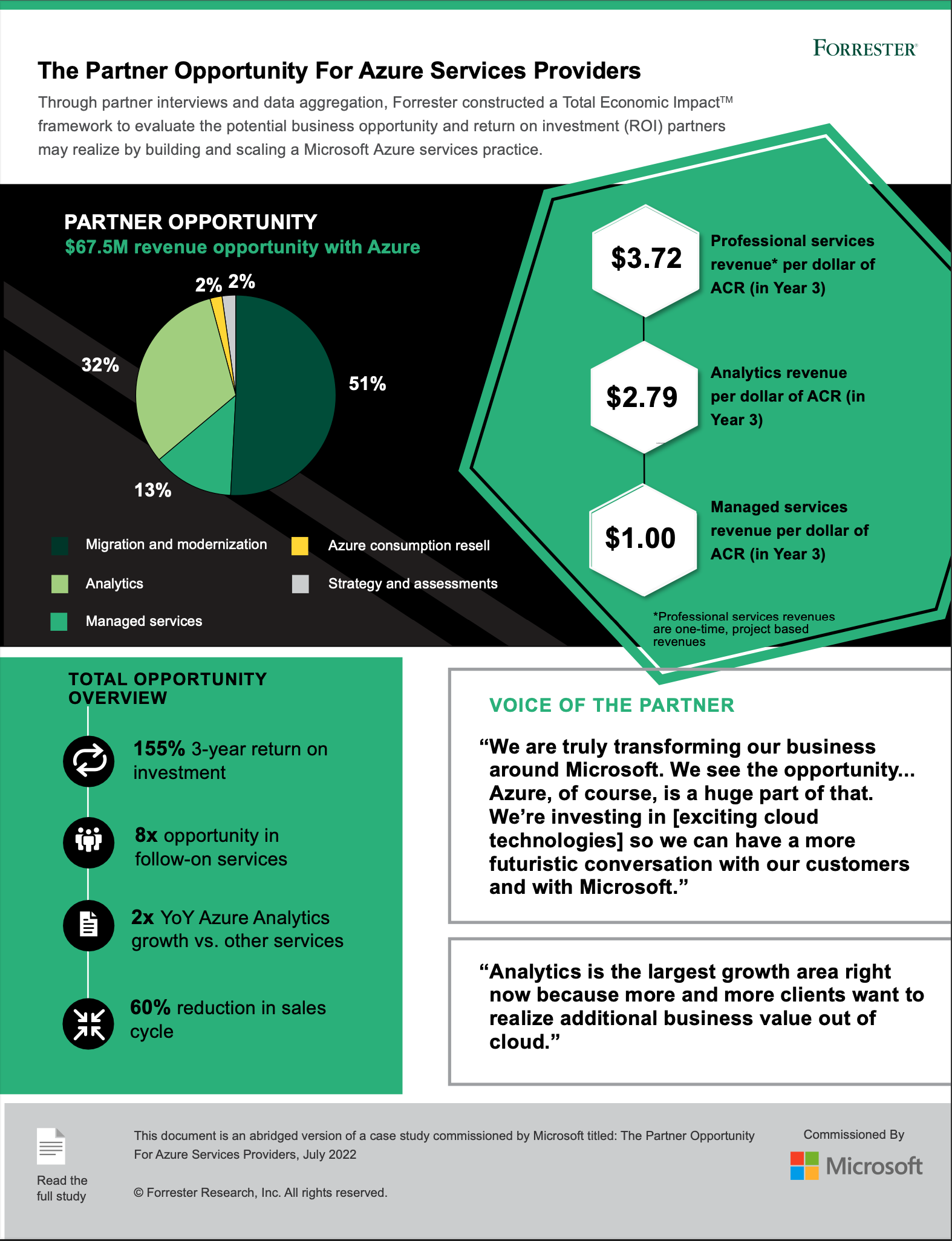

Microsoft commissioned Forrester Consulting to conduct a Total Economic Impact™ (TEI) study to examine the potential business opportunity and return on investment (ROI) partners may realize by building and scaling a Microsoft Azure services practice.2 The purpose of this study is to provide potential and existing partners with a framework to evaluate the potential business opportunity associated with building an Azure services practice by delivering professional services and managed services and offering Azure consumption resell and business support as part of the Microsoft partner ecosystem.

To better understand the revenue streams, investments, and risks associated with an Azure services practice, Forrester interviewed fourteen representatives of existing Azure services partners with experience delivering professional and managed services around Azure. To illustrate the financial impact and subsequent partner business opportunity for Azure services partners, Forrester aggregated the characteristics of these interviewees and combined the results into a single composite organization. The composite organization is based in the US with global operations. It also offers a broad portfolio of services around Azure to its customers — including both professional and managed services.

- Mbenoye Diagne, David Park

Key Findings

-

ROI

155%

-

Gross Margin

45%

-

Operating Margin

31%

-

Net present value (NPV)

$41.05M

Key Findings

Revenue opportunities. The composite partner organization captures the following revenue streams, which are representative of those experienced by interviewees’ organizations:

-

Azure strategy and assessments.

Strategy and assessment work sets the foundation for preliminary opportunities and ongoing partner-client relationships. Although some partners are now forgoing this step when clients understand their needs, most of the composite organization’s clients continue to complete assessments. In Forrester’s three-year analysis, Azure strategy and assessment work made up 2% of the composite partner organization's total gross profits.

-

Azure migration and modernization.

Partners offer professional services including migration, modernization, and application development to help clients take advantage of Azure. In the past, most partners viewed these services as separate, sequential work units. Now they are taking more flexible, outcomes-centric approaches to these workloads to match the mindsets and needs of their clients. In Forrester’s three-year analysis, Azure migration and modernization work totaled 51% of the composite partner organization's total gross profits

-

Azure managed services.

Beyond professional services work like migration and modernization, partners often offer managed services to their clients to maximize the benefits of their Azure environment on an ongoing basis. Partners are increasingly tailoring their managed services offerings to fluidly meet the business outcomes clients desire. In Forrester’s three-year analysis, Azure managed services work comprised 13% of the composite partner organization's total gross profits.

-

Azure analytics services.

Azure analytics is the newest and fastest growing revenue stream in the Azure services partner opportunity. Analytics work is focused on helping customers extract value from their data through modernization activities and building data integrations into other technologies. In Forrester’s three-year analysis, Azure analytics work made up 32% of the composite partner organization's total gross profits.

-

Azure consumption resell and business support.

Partners resell Azure consumption as an additional revenue stream, allowing them to further entrench themselves into their clients' Azure experience. This reselling allows partners to better manage, support, and improve the partner-client relationship and drive more Azure professional and managed service deals. In Forrester’s three-year analysis, Azure consumption resell and business support work totaled 2% of the composite partner organization's total gross profits.

Investments. Beyond direct service delivery costs (including base compensation and corporate overhead expenses for delivery resources), which are embedded in the gross margin calculations of each revenue stream, partners also invested in:

-

Talent acquisition and hiring.

The composite partner commits to serving their clients well by investing in a talented, capable team. Over Forrester’s three-year analysis, talent acquisition and hiring expenses made up 5.35% of the composite partner organization’s total Azure practice investments.

-

Research and development (R&D).

The composite partner invests in developing custom tools, scripts, templates, and processes not only before partnering with Microsoft, but after launching its practice to continue improving and offering new services and solutions. Over Forrester’s three-year analysis, research and development expenses totaled 10.45% of the composite partner organization’s total Azure practice investments.

-

Training.

To achieve practice-level competencies and improve Azure service delivery, the composite partner invests in Microsoft training courses and internal training programs. Over our three-year analysis, training expenses amounted to 3.97% of the composite partner organization’s total Azure practice investments.

-

Sales and marketing.

Spend on sales and marketing leads to new clients and service deals for the composite partner. Over Forrester’s three-year analysis, sales and marketing expenses accrued to 66.86% of the composite partner organization’s total Azure practice investments.

-

General and administrative (G&A) expenses.

The composite partner has standard expenses related to its offices, utilities, and back-office functions. Over Forrester’s three-year analysis, research and development expenses made up 13.37% of the composite partner organization’s total Azure practice investments.

The representative interviews and financial analysis found that a composite partner organization experiences total present value (PV) gross profits of $67.57 million over three years versus investments and overhead expenses of $26.52 million, adding up to a net present value (NPV) of $41.05 million and an ROI of 155%.

Azure Services Partner Pro Forma Revenue And Margin Opportunity: Three-Year Analysis (USD)

| Ref. | Metric | Source | Initial | Year 1 | Year 2 | Year 3 |

|---|---|---|---|---|---|---|

| PL1 | Azure professional services revenues | At+Bt | $22,425,000 | $33,247,500 | $49,343,775 | |

| PL2 | Azure managed services revenues | CT | $2,160,000 | $5,760,000 | $13,320,000 | |

| PL3 | Azure analytics services revenues | Dt | $12,000,000 | $21,060,000 | $36,960,300 | |

| PL4 | Azure consumption resell revenues | Et | $15,000,000 | $15,300,000 | $15,606,000 | |

| PL5 | Total revenue | PL1+PL2+PL3+PL4 | $37,275,000 | $60,771,300 | $100,341,951 | |

| PL6 | Total gross profit | At+Bt+Ct | $15,131,813 | $26,034,866 | $45,209,694 | |

| PL7 | Total gross margin | PL6/PL5 | 41% | 43% | 45% | |

| PL8 | Talent acquisition and hiring expenses | F2 | $0 | $298,200 | $486,170 | $802,736 |

| PL9 | Research and development expenses | F3 | $1,118,250 | $372,750 | $607,713 | $1,003,420 |

| PL10 | Training expenses | F4 | $186,375 | $186,375 | $303,857 | $501,710 |

| PL11 | Sales and marketing expenses | F5 | $0 | $3,727,500 | $6,077,130 | $10,034,195 |

| PL12 | General and administrative expenses | F6 | $0 | $745,500 | $1,215,426 | $2,006,839 |

| PL13 | Total operating expenses | PL8+PL9+ PL10+PL11+PL12 | $1,304,625 | $5,330,325 | $8,690,296 | $14,348,899 |

| PL14 | Operating income | PL6-PL13 | -$1,304,625 | $9,801,488 | $17,344,570 | $30,860,795 |

| PL15 | Operating margin | PL14/PL5 | 26% | 29% | 31% |

Benefits (Three-Year)

TEI Framework And Methodology

From the information provided in the interviews, Forrester constructed a Total Economic Impact™ framework for those partners considering building and growing a Microsoft Azure services practice.

The objective of the framework is to identify the revenue streams, investments, flexibility, and risk factors that affect the investment decision. Forrester took a multistep approach to evaluate the holistic opportunity for partners building and growing a Microsoft Azure services practice.

-

DUE DILIGENCE

Interviewed Microsoft stakeholders and Forrester analysts to gather data relative to Azure services.

-

INTERVIEWS

Interviewed fourteen representatives at partner organizations with existing Azure services practices to obtain data with respect to costs, benefits, and risks.

-

COMPOSITE ORGANIZATION

Designed a composite partner organization based on characteristics of the interviewees’ organizations.

-

FINANCIAL MODEL FRAMEWORK

Constructed a financial model representative of the interviews using the TEI methodology and risk-adjusted the financial model based on issues and concerns of the interviewees.

-

CASE STUDY

Employed four fundamental elements of TEI in modeling the impact of an Azure services practice: revenue, investments, flexibility, and risks. Given the increasing sophistication of ROI analyses related to IT investments, Forrester’s TEI methodology provides a complete picture of the total economic impact of investment and partnership decisions. Please see Appendix A for additional information on the TEI methodology.

DISCLOSURES

Readers should be aware of the following:

This study is commissioned by Microsoft and delivered by Forrester Consulting. It is not meant to be used as a competitive analysis.

Forrester makes no assumptions as to the potential ROI that other organizations will receive. Forrester strongly advises that readers use their own estimates within the framework provided in the study to determine the appropriateness of an investment in an Azure services practice.

Microsoft reviewed and provided feedback to Forrester, but Forrester maintains editorial control over the study and its findings and does not accept changes to the study that contradict Forrester’s findings or obscure the meaning of the study.

Microsoft provided the partner names for the interviews but did not participate in the interviews.